Benefits of enrolling in direct deposit:

• Convenient

• Immediate access to cash

• Safe and secure

• Get paid up to one day earlier*

To get your direct deposit started, fill out the form below and return it to your payroll department.

• General direct deposit form

• County of San Diego employee direct deposit form

• County of San Diego retired employee direct deposit form

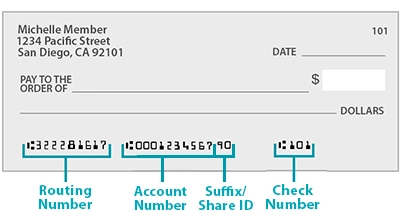

SDCCU’s ABA Routing Number is 322281617. Be sure to provide your account suffix at the end of your account number (e.g. 1234567 + 90).

Where can I find my account number?

Your account number is printed at the bottom of your personal checks. You can also find this number in Internet Branch online banking. Your account number will be displayed at the top right of your screen. Click on your account number in the upper right hand screen, then click “Account Number Help”.

Each sub account (savings, checking, etc.) has a 2 digit suffix attached to your account number. The leading zeros and suffix are required for checks, ACH, wire transfers and direct deposit. Your full account number is 12 digits.

For example: 000 + 1234567 + 90 = 000123456790 -or- 00 + 12345678 + 92 = 001234567892.

What is a suffix/share ID?

A suffix/share ID helps differentiate between account types. For example, if you set up direct deposit and want it to go to your checking account, you need to add your checking suffix, 90 for example, to your account number. You may find your account suffix in Internet Branch online banking or on your account statements.

Existing customers, log into Internet Branch

free online banking. Don't have a checking account with SDCCU? We have a variety of checking accounts to fit every member's unique needs. Open one today!

OPEN A CHECKING ACCOUNT

*SDCCU offers credit of your direct deposit approximately one business day before your actual pay date as long as your employer provides SDCCU notification with two to three business days in advance, which many employers do. Actual deposit date is not guaranteed. SDCCU assumes no liability for not depositing funds to your account early.