Primary Account Holder

The SDCCU mobile banking app is available for both iOS and Android devices. Once you have enrolled in Internet Branch, please download the SDCCU app.

Save yourself a trip to the branch or ATM with our convenient eServices. Enrolling is easy and takes just a few minutes. You can enroll via our desktop online banking or in the SDCCU mobile banking app. You will use the same Username and Password for both. You'll need your account number to get started.

The SDCCU mobile banking app is available for both iOS and Android devices. Once you have enrolled in Internet Branch, please download the SDCCU app.

Each account holder will have separate logins. Primary member and joint members will enroll separately with unique usernames and passwords. Joint members can click Sign Up Now under the login box on the homepage.

To enroll in Internet Branch online banking for business accounts, follow the instructions for joint account holders in this video. The only difference is instead of inputting the joint account holder's information, you will input the Authorized Signer's information.

If you have questions or concerns, please contact us at (877) 732-2848. Message and data rates may apply.

FAQS

We currently send one time passcodes through text message or phone call. However, you can forward your text messages to your email if you use a call forwarding and voicemail services like Google Voice or similar services.

We provide Internet Branch online and mobile banking to our members at no charge. Message and data rates may apply.

Visit sdccu.com/forgot to recover your username or reset your password.

There are a few ways you can obtain your account number.

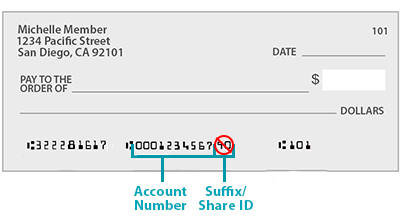

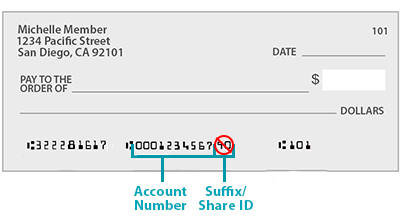

First, your account number is on your SDCCU checks. Your account number will be the bottom middle number, without the last 2 digits. For example, if the number on your checks is 000123456790, your account number is 0001234567. See graphic below.

Second, come into your local SDCCU branch and ask one of our staff to assist you.

Third, call us at (877) 732-2848.

We’ve enhanced the security of our Internet Branch accounts by requiring all users to enroll separately.

Our enhanced authentication service helps to ensure your identity and information is protected. We will send you a one-time passcode via a text or phone call with a passcode that you need to enter. You will see this at

login and when performing select transactions within online banking.

Yes, you can enroll in text banking in online banking. To enroll in text banking, add your mobile phone number to Internet Branch.

If you have multiple SDCCU accounts with separate account numbers, you will need to enroll those additional accounts in email alerts and/or MMS text alerts. To set up MMS text alerts, you will need to input your cell phone number followed by your carrier’s gateway address under Phone Number when you enroll for text banking.

For example, if your phone number is (123) 456-7890 and your carrier is AT&T, you will input the following: 1234567890@mms.att.net.

Message and data rates may apply.

Thanks for applying for a loan with SDCCU!

Before we continue, please answer the following questions:

Before we continue, please answer the following questions:

Visiting external link:

By clicking the "Go" button below, you acknowledge that you are leaving sdccu.com and going to a third party website. You are entering a website which has separate privacy and security policies. SDCCU® is not responsible or liable for any content, products, services, privacy and security or external links on the third party's website.

Thank you for your interest in SDCCU.

It's easy to join online in a few steps and apply for your new loan at the same time

Log into Internet Branch online banking to apply for this loan under your existing account. If you want a separate account, use the New to SDCCU options to the left.

LOG IN