Please enter a ZIP code or city

Access your SDCCU accounts quickly, easily and securely through Internet Branch online banking. Haven't enrolled yet? Enroll now.

Review your account summary, transaction history, copies of paid checks and your monthly eStatements. View and order checks, pay bills with Bill Payer Plus® and more. You can also download your account history data to Quicken® or QuickBooks™.

Download the mobile app today.

Stay up to date on your account details and prevent fraudulent activity with email and text alerts on your account.

Save time and money by making payments online with the convenience of our easy online bill payment service.

Deposit checks real-time with SDCCU Mobile Deposit.

FAQS

Yes. Each monthly account statement you currently receive can be delivered as an eStatement.

No, to protect your information we do not email your tax form to you. We will send you an email to notify you that your eTax Form is ready for you to view through Internet Branch. You must provide us your current email address in order to receive eTax Form alerts. There will also be a link within Internet Branch notifying you that you have new eTax Forms to view.

You may cancel eNotices at any time by sending us a Secure Message through Internet Branch or by calling us at (877) 732-2848. Please allow 10 business days for your request to be completed.

You may cancel eTax Forms at any time by sending us a Secure Message through Internet Branch or by calling us at (877) 732-2848. Please allow 10 business days for your request to be completed.

No, to protect your information, we do not email the notice to you. We will send you an email to notify you that a new eNotice is ready for you to view through Internet Branch. You must provide us your current email address in order to receive eNotice alerts. There will also be a link within Internet Branch notifying you that you have new eNotices to view.

Any deposit account, including your primary savings account, makes you eligible to enroll in Internet Branch. Just click Enroll Today.

You will need Adobe Acrobat Reader to view your eNotices. If you do not have this program you can download it for free at adobe.com.

No. All you need to receive eStatements is to enroll in Internet Branch, enroll in eStatements and have Adobe Acrobat Reader. If you do not already have Acrobat Reader you can download it here for free.

You will need Adobe Acrobat Reader to view your eTax Forms. If you do not have this program you can download it for free at adobe.com.

If you forgot your password, reset your password here. For a step-by-step tutorial, view the video below:

You can open an account online with SDCCU in just a few easy steps. You can transfer funds from an existing SDCCU account, with your credit or debit card or from a checking or savings account at another financial institution. You’ll just need your account number and the bank routing number of the bank account you are transferring from.

You can receive an eBill from hundreds of billers. Look for the eBill Sign Up image next to the biller name on the Bill Payer Plus main screen. eBills are included with Bill Payer Plus, there is no additional fee for this service. eBills are available from popular companies like: AT&T®, American Express®, Cox® Communications, DirecTV®, Macy's, SDG&E, State Farm Insurance®, Sprint™ and Verizon.

With eBills you can:

Log into Internet Branch and click Bill Payer Plus, then look for the eBill icon next to your eligible billers.

View your eStatements securely by logging onto Internet Branch and clicking eStatements under the Accounts tab. Your eStatement will be available by the 6th of each month. Each eStatement will remain viewable for up to 7 years. You can also save a copy of your eStatement to your computer.

You will be emailed each month when your eStatement is ready. Please make sure your email address is current under the Self Service tab in Internet Branch.

Your eNotices will be available for up to 90 days.

Your current year and prior year tax forms will remain available.

We provide Internet Branch online and mobile banking to our members at no charge. Message and data rates may apply.

Internet Branch online banking is safe and secure. Learn more about online banking security.

Log into Internet Branch online banking or on the SDCCU mobile banking app and click eStatements to enroll.

For transfers between separate accounts at SDCCU, please complete the Online Banking Transfer Form and take it to your nearest branch or mail it to us. Please contact us at (877) 732-2848 for more information.

No, eNotices are provided free of charge for your convenience.

No, eTax Forms are provided free of charge for your convenience.

eBills is an optional feature that provides you electronic bills from select billers. If you sign-up for an eBill, a red eBill logo will show up next to the biller name when a new bill arrives. Depending on the vendor, the eBill may replace your paper bill.

An eStatement in an electronic copy of your account statement, available to you online, at any time, through Internet Branch online banking. An eStatement looks identical to your paper statement and is stored online for up to 7 years. eStatements help save the environment and save you the hassle of filing your bulky monthly statements.

Convenience, security and real-time access around the clock are just a few advantages of online banking with SDCCU. Accessing your SDCCU accounts online can be a better way to keep track of your finances, stick to your budget or even catch erroneous charges. Best of all, it can help you go paperless, protecting your identity and the environment.

eStatements are free for all members.

Visit sdccu.com/forgot to recover your username or reset your password.

You need to enroll in our free Internet Branch online banking service to access Bill Payer Plus. Once you are logged into Internet Branch, simply click on the Bill Payer Plus tab to enroll and you are ready to start paying your bills the easy way.

Bill Payer Plus is $0 with a Free Checking with eStatements account or a Wave Checking account. For other accounts, the $4.95 monthly fee is waived when used to make three or more payments per calendar month.

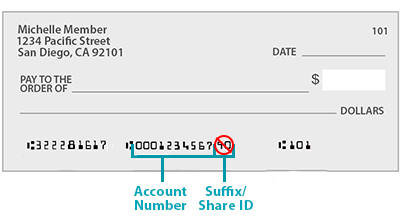

There are a few ways you can obtain your account number.

First, your account number is on your SDCCU checks. Your account number will be the bottom middle number, without the last 2 digits. For example, if the number on your checks is 000123456790, your account number is 0001234567. See graphic below.

Second, come into your local SDCCU branch and ask one of our staff to assist you.

Third, call us at (877) 732-2848.

An eNotice is an electronic copy of a paper mailed notice available through Internet Branch, our online banking system. When you sign up to receive eNotices, you will no longer receive paper notices in the mail. (Select notices will still come in the mail.)

An eTax Form is a legal copy of your SDCCU tax form.

Bill Payer Plus is our online bill payment service. Paying your bills with Bill Payer Plus is convenient, easy and secure. With Bill Payer Plus you can view select bills, pay almost all of your bills and view past payments with just a few clicks of your mouse.

Online banking is a way to conduct your financial business securely on a website or mobile app. To enroll you will need your SDCCU account number, last name, social security number and birth date. You can access your account 24/7 at sdccu.com or through our mobile app.

eNotices include Insufficient Funds, Certificate Maturity, late payment notices and most other SDCCU notices. Not all notices are currently available through eNotices and you may receive a paper notice in the mail occasionally.

Generally, monthly statements and/or eStatements will be sent the first week of each month.

The money will be withdrawn from your account when the bill is paid, not the day you schedule the payment. If you schedule a bill today to go out the first of next month, the money will come out of your account on the first of next month.

Bill Payer Plus gives you the freedom to pay almost anyone, at any time. Tax or court ordered payments, payments to payees outside of the United States, State and Federal tax payments are prohibited.

We’ve enhanced the security of our Internet Branch accounts by requiring all users to enroll separately.

Our enhanced authentication service helps to ensure your identity and information is protected. We will send you a one-time passcode via a text or phone call with a passcode that you need to enter. You will see this at

login and when performing select transactions within online banking.

Your Social Security Number will be shortened on your eTax Form for added security.

Yes, you can enroll in text banking in online banking. To enroll in text banking, add your mobile phone number to Internet Branch.

If you have multiple SDCCU accounts with separate account numbers, you will need to enroll those additional accounts in email alerts and/or MMS text alerts. To set up MMS text alerts, you will need to input your cell phone number followed by your carrier’s gateway address under Phone Number when you enroll for text banking.

For example, if your phone number is (123) 456-7890 and your carrier is AT&T, you will input the following: 1234567890@mms.att.net.

Message and data rates may apply.

“I have been with SDCCU for many years. I now live outside of their service area, but thanks to online banking and the mobile app, I am still able to maintain my accounts with SDCCU, and will continue to do so as long as possible.”

Be a Part of San Diego's

BEST Credit Union

Check out these additional products you can view within online banking.

SDCCU has over 30,000 surcharge-free ATMs and 39 branch locations.

Open an account online today!

Thanks for applying for a loan with SDCCU!

Before we continue, please answer the following questions:

Before we continue, please answer the following questions:

Visiting external link:

By clicking the "Go" button below, you acknowledge that you are leaving sdccu.com and going to a third party website. You are entering a website which has separate privacy and security policies. SDCCU® is not responsible or liable for any content, products, services, privacy and security or external links on the third party's website.

Thank you for your interest in SDCCU.

It's easy to join online in a few steps and apply for your new loan at the same time

Log into Internet Branch online banking to apply for this loan under your existing account. If you want a separate account, use the New to SDCCU options to the left.

LOG IN