Primary Account Holder

The SDCCU mobile banking app is available for both iOS and Android devices. Once you have enrolled in Internet Branch, please download the SDCCU app.

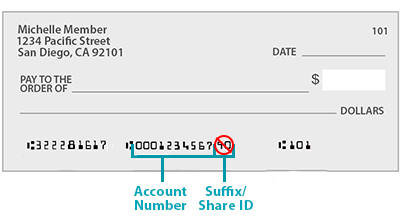

Save yourself a trip to the branch or ATM with our convenient eServices. Enrolling is easy and takes just a few minutes. You can enroll via our desktop online banking or in the SDCCU mobile banking app. You will use the same Username and Password for both. You'll need your account number to get started.

The SDCCU mobile banking app is available for both iOS and Android devices. Once you have enrolled in Internet Branch, please download the SDCCU app.

Each account holder will have separate logins. Primary member and joint members will enroll separately with unique usernames and passwords. Joint members can click Sign Up Now under the login box on the homepage.

To enroll in Internet Branch online banking for business accounts, follow the instructions for joint account holders in this video. The only difference is instead of inputting the joint account holder's information, you will input the Authorized Signer's information.

If you have questions or concerns, please contact us at (877) 732-2848. Message and data rates may apply.

FAQS